Honest Reviews Of Bulldog Pet Insurance Companies We Found In America

$10 to $100 the price range is very wide due to the fact that some dogs cost more to replace and others get alot more ailments = higher vet bills. Luckily almost every broker offers different price plans to choose from.

The best way to measure the value of a plan, is to look at what % of a claim they will cover and if there is any limits, initial excess and if they bump up your premium the following year if you claim. Weigh it all up.

PetsBest Review

Prices start at $10 monthly for accidental cover only. Lovely website and thousands of positive online reviews, but these are fake Trustpilot reviews! Another company trying to push down the negative reviews, go check them out on Trustpilot yourself. They score 2/5 on Yelp.

What We Like

Nice transparent website with helpful videos, many bulldog photos on their website. Claim to have paid out more than $300m over 15 years.

What We Dislike

Long time to respond to peoples claims. Also I will mention again we found alot of fake positive reviews, they link to other review websites so they know customers want social proof before buying. They even boast about their rating by the better business bureau... odd.

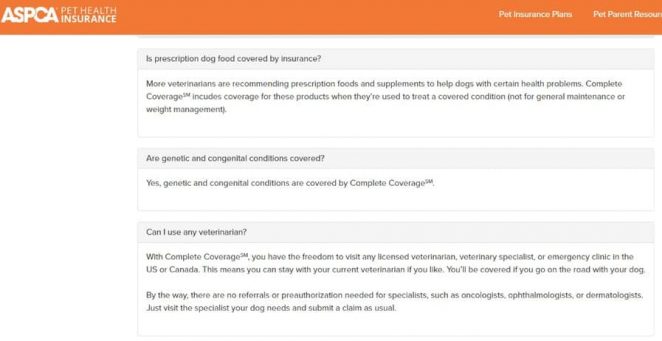

ASPCA Pet Health Insurance Review

This is the insurance arm of a non-profit pet rescue. We've seen claims that this is just to avoid taxes however there is bona fide articles of them rescuing animals. They have thousands of great reviews on Trustpilot, it's shame though that most of them are fake. Under writer is Crum and Forster who also covers 24petwatch (they score a 1/5 on Yelp!)

What We Like

The fact that aspca helps animals and has a nice website showing their work with recent news articles. No upper age limit on dogs, must be +8 weeks old, prices start at $10 monthly for accident cover only.

What We Dislike

All their fake reviews ruin any trust. Couldn't recommend this broker? charity?

Healthypaws Insurance Review

Yelp! is alive with people accusing them of price gouging, but check out the pics of the adorable bulls on their site 🙂 Prices are between $15-90 and they claim to process 99% of claims in 2 days. They cover cancer, hereditary conditions, emergency and so on. Their website is nice, well worth a look.

What We Like

What We Dislike

The volume of people who are claiming that they keep raising the premiums on them. A common enough complaint but 20-30% price hikes each year would kill anybodies pocket.

Trupanion Insurance Review

Insuring both USA and Canadian customers, Trupanion is the single biggest broker we could find by volume of reviews. They're like the Amazon of bulldog insurance right now, so go check them out first and then compare from that.

What We Like

Reputable, well known, unlimited coverage, active on review sites at replying to people, decent website not from the 90's.

What We Dislike

Lots of negative reviews about premiums creeping up +20% each year, other insurers will only increase the premium inline with your claims.

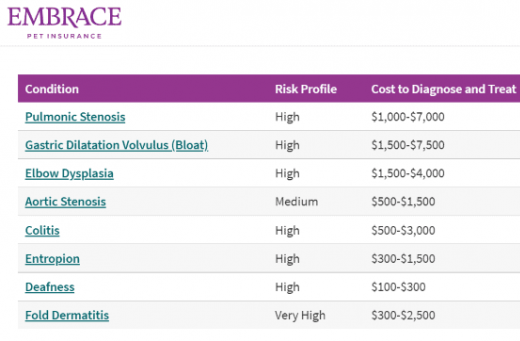

Embrace Pet Insurance Review

Appears to be very popular, lots of bloggers mentioning them but their Trustpilot of full of fake reviews, not the first on this list. They won't cover orthopedic for the first 6 months, and apparently are slow to approve claims, perhaps to avoid initial weekly vet bills. If you don't claim they promise to reduce your premium by $50 the next year, rare to hear that.

What We Like

One of the only brokers that direct links to multiple review sites about them. They are busy so there's lots to look through, but again lots of fake reviews too. Super quick site. I didn't see complaints about price gouging.

What We Dislike

Lots of waiting periods for different conditions before your policy activates. I think the fake positive reviews put me off the most, other than that they are a regular broker worth getting a quote from. Add these guys to your list.

The Most Common Questions People Are Asking Google.

How To Get Cheaper Bulldog Insurance?

Checking for discount codes or haggling on the phone can sometimes yield results but it's mostly a waste of time. Instead just try many brokers annually and see who's cheapest and see if their quote makes sense compared to potential bills.

Is It Financially Worth Getting Insurance For My Dog?

From an accounting point of view the more your dog costs to buy the more it makes sense to insure it. Putting love aside for one moment consider a car or property, you wouldn't like to insure an old rust bucket but if something bears an enormous risk of financial loss then cover yourself. Bulldogs are not cheap anywhere in the world, they're considered an expensive dog, with expensive vet bills, so get some quotes and weigh up your potential risk.

Do Pet Insurers Actually Payout?

Yes they payout, but nearly all of them have small print which you really need to read. It may include a clause that requires an annual checkup or booster that without it your coverage stops even though your payments are up to date.

Will Pet Insurance Cover Pregnancy?

No, that would be exploited by breeders in a heart beat.

Does Pet Insurance Cover Newborn Puppies?

Yes, some insurers depending on the plan you select will cover newborns, but they will most likely exclude some illnesses until they reach a more mature age. Those illnesses found later will be known as "pre-existing conditions" and thus excluded from coverage on future policies offered to you.

Can You Get Insurance For A Bulldog

Yes, almost 100% of brokers cover bulldogs but not all will cover their hereditary or common illnesses. Some brokers have no problem covering their skin allergies for example, but another may exclude that in the small print on their policy so read that small print.